Gifts from Retirement Plans During Life

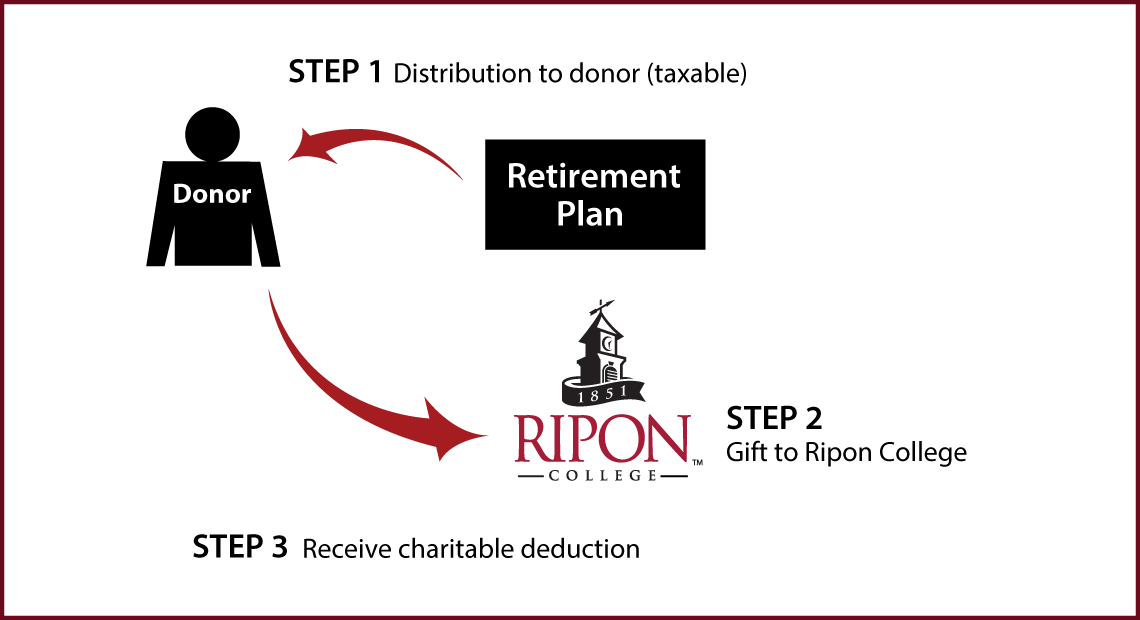

How It Works

- You take a distribution from your qualified retirement plan or IRA that is includable in your gross income

- You make a gift of the distribution or of other assets equal in value to the distribution

- You receive an offsetting charitable deduction

- If you are 70½ or older, read ahead about the IRA rollover opportunity available to you

Benefits

- You may draw on perhaps your largest source of assets to support the programs that are important to you at

Ripon

- The distribution offsets your minimum required distribution

- If you use appreciated securities instead of cash from your distribution to make your gift, you'll avoid the capital-gain tax on the appreciation

More Information

Which Gift Is Right for You?

Back

© Pentera, Inc. Planned giving content. All rights reserved.

Disclaimer