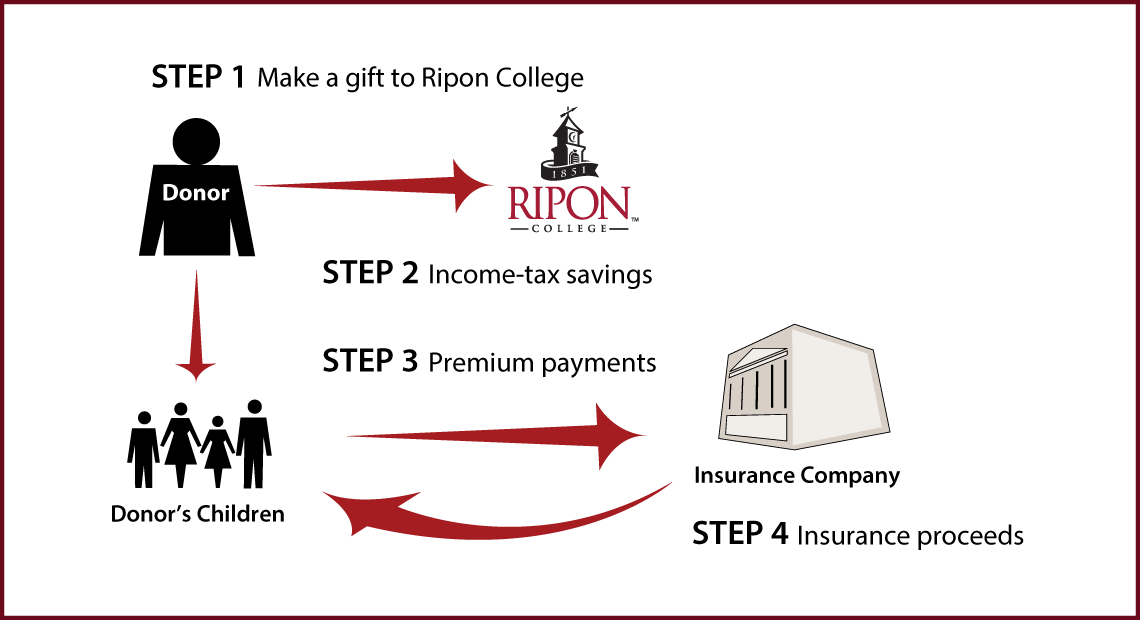

Life Insurance to Replace Gift—Wealth Replacement

How It Works

- You make a gift to Ripon

- You give the tax savings from the charitable deduction to your children

- Your children purchase an insurance policy on your life with the tax savings

- Your children will receive the proceeds upon your death

Benefits

- You can make a significant gift to Ripon without diminishing the amount your family will receive

- Your tax savings finance this life insurance policy

More Information

Which Gift Is Right for You?

Back

© Pentera, Inc. Planned giving content. All rights reserved.

Disclaimer